If your pizzeria hires delivery drivers, you've probably got headaches! Make sure that you are up to speed on the details of how to pay your drivers legally, while making smart decisions about how to incent drivers to give great service!

Delivery Driver Tip Credit

In most states, delivery drivers are eligible for the tip credit wage, which means you can pay less than minimum wage as long as tips make up the difference. However, there's an important caveat to this rule. Unlike servers, who spend their entire shift waiting on tables and potentially making tips, most drivers are not on the road delivering pizzas all night. Sometimes, they are in the shop waiting for their next delivery to be ready. On average, our customers find that most drivers spend 60% of their shift on the road, and the rest of the time in the shop. So to properly and legally take advantage of the tip credit wage, you must pay minimum wage for the time the driver is not on the restaurant.

So how do you track this? The right point of sale system designed for pizza delivery will make it easy for you. For example, Thrive POS will automatically calculate the amount of time drivers spent on the road vs. in house, and divide the shift accordingly among the two pay rates.

So how do you track this? The right point of sale system designed for pizza delivery will make it easy for you. For example, Thrive POS will automatically calculate the amount of time drivers spent on the road vs. in house, and divide the shift accordingly among the two pay rates.

When it comes to overtime, things get even more complicated. Federal regulations call for weighted overtime - which means if I've worked the first 30 hours of the week as a Manager at $15 per hour, and the next 10 as a driver for $8 per hour, my overtime rate is the weighted average of the two. I can't pay hour 41 for the week as just a driver wage x time and a half. I have to take into account the amount of time worked as a manager during the week as well, and pay the overtime premium as 1.5x that average wage. Many point of sale systems don't take different wage rates into account when calculating overtime, so be sure that yours is doing it correctly!

The Bureau of Labor has been investigating more and more pizzerias on this issue, so be sure that you are paying your drivers correctly!

Tip: This data is also incredibly useful when it comes to your worker's comp insurance audit. You may be able to pay a lower rate based on the percentage of time that drivers spend in house.

Driver Mileage Tracking

Pizzerias pay their drivers in lots of different ways - sometimes it's a flat fee per order, or a flat fee that varies based on what zone the order goes to, or based on actual mileage. Keep in mind that no matter how you calculate the fee, if you want it to be considered a "mileage reimbursement" rather than a wage (which you and your driver will have to pay taxes on), you must track the mileage driven and ensure that your driver fee does not exceed the IRS maximum.

For example, in 2024 the IRS mileage reimbursement rate is 54 cents per mile. If your driver took 10 deliveries and got paid $2 per delivery, or $20 total, he or she would have to have driven at least 37 miles during that shift. If the actual mileage was less, then some of those driver fees are taxable as income.

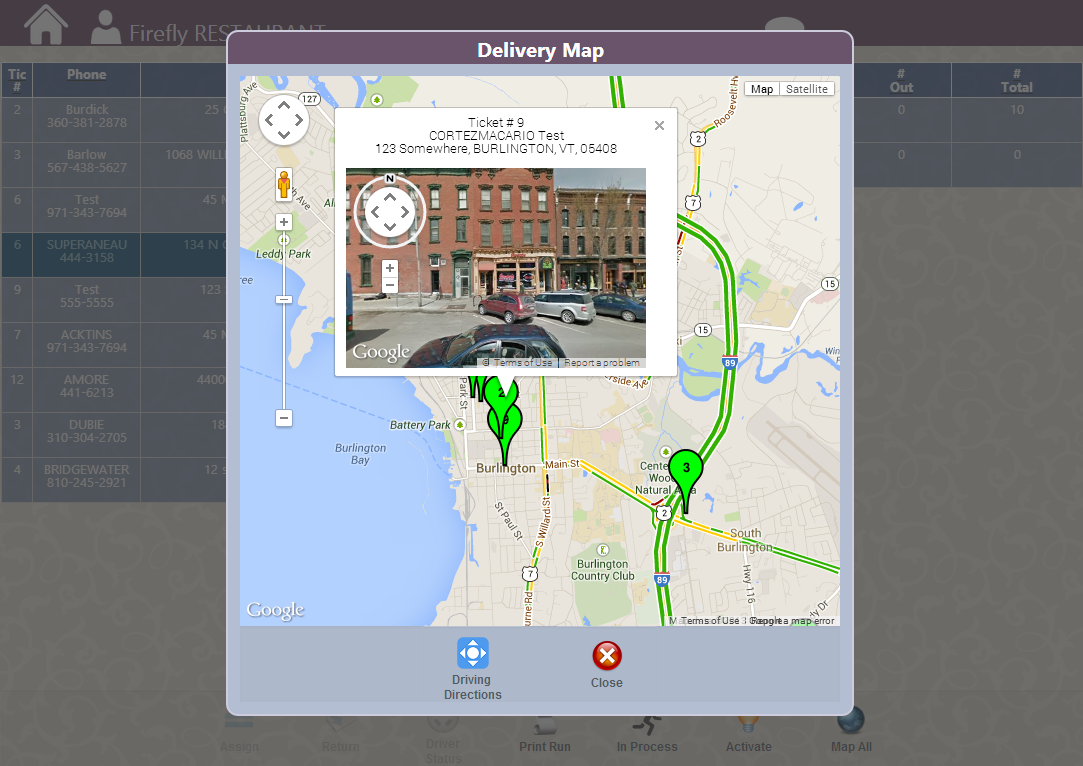

Keeping track of your driver mileage doesn't have to be a paperwork nightmare! This is another thing your point-of-sale system can help you with. The Thrive POS system gives you two options for tracking mileage - either with driver-entered odometer readings at the start and end of their shift, OR completely automated with Google-calculated mileage for each run. Whether you use this information to pay per mileage or keep the flat fee, you'll have all the supporting documentation and reports you need to keep your mileage reimbursements on the right side of the IRS.

Driver Security

When delivery drivers are all around town with your money in their pockets, you want to be sure everything is accounted for at the end of the night. Look for technology to help. Driver tracking apps let you map where all your drivers are at any time. Secure drop requirements keep track of how much cash a driver has on hand and prompts for a drop before making another delivery. Coupon tracking features will make sure that drivers turn in a physical coupon when required, and any coupons added after the delivery was made will be a "red alert".

Driver Performance

With all the expense and hassle of managing delivery drivers, you want to make sure you are recognizing and incentivizing your best performers. Common ways to track driver performance include monitoring delivery times, comparing tip %, and of course tracking on-time arrivals for their shift. You could also send surveys out to your customers asking for feedback on their driver as well as their food (our Thrive POS Loyalty solution can automate this process for you!)

Enjoyed this read? Subscribe here!

Subscribe Here!