Many restaurants work closely with tax-exempt customers such as schools or churches to provide catering for special events or school lunches. The FireFly point-of-sale system will remind you when a customer is tax-exempt. Here's how to use this feature:

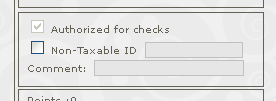

1. When setting up the customer, click on the "MORE" button and check the "Tax Exempt" box. You can also enter an identification # if needed.

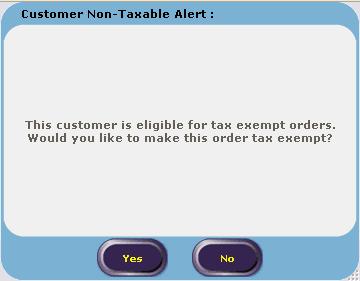

2. Now, each time you select that customer to place an order, you'll be asked if you want to make the sale a non-tax sale:

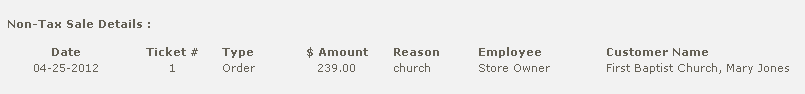

3. If you pick YES, the sale will be a non-tax sale and details will be reported on your tax report:

That's all there is to it! An easy way to improve customer service for these key account.

Duessa Holscher

Duessa was the Founder and Managing Partner at FireFly Technologies until it was acquired by Granbury Solutions in 2010, where she served as Chief Product Development Officer until her appointment as President in 2019.