Many restaurants work closely with tax-exempt customers such as schools or churches to provide catering for special events or school lunches. The FireFly point-of-sale system will remind you when a customer is tax-exempt. Here's how to use this feature:

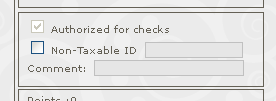

1. When setting up the customer, click on the "MORE" button and check the "Tax Exempt" box. You can also enter an identification # if needed.

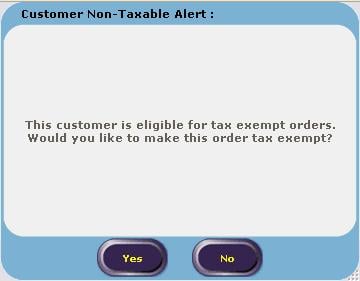

2. Now, each time you select that customer to place an order, you'll be asked if you want to make the sale a non-tax sale:

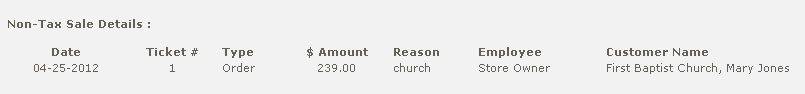

3. If you pick YES, the sale will be a non-tax sale and details will be reported on your tax report:

That's all there is to it! An easy way to improve customer service for these key account.