The end of the year is approaching, and there's no better time to invest in new tools and technology for your restaurant! This may be the last year to take advantage of the Section 179 deduction for equipment purchases, originally part of the Small Business Jobs & Credit Act of 2010. With Section 179 savings, you can take advantage of tax savings that will help you cover the costs of a point-of-sale system for your restaurant!

How it Works

The Section 179 provision allows you to deduct the full cost of equipment purchases- up to $2,000,000, this year. Let’s look at an example of how this saves you money! Joe’s Pizza, a growing shop, is expecting to finish the year with a taxable profit of $35,000. If Joe does nothing, he’ll probably have to pay a good portion of that to Uncle Sam to cover income tax, maybe even as self-employment tax. Let’s estimate this to be around $35%, or $12,250.

$2,000,000, this year. Let’s look at an example of how this saves you money! Joe’s Pizza, a growing shop, is expecting to finish the year with a taxable profit of $35,000. If Joe does nothing, he’ll probably have to pay a good portion of that to Uncle Sam to cover income tax, maybe even as self-employment tax. Let’s estimate this to be around $35%, or $12,250.

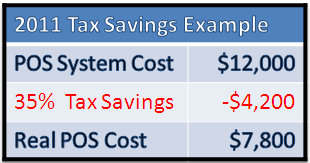

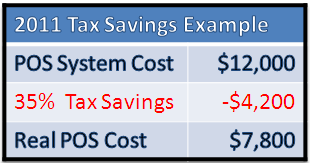

But if Joe purchases equipment, like that point-of-sale system he's been thinking about adding to his business, he can reduce the taxable profit, even if he finances the equipment purchase. So, after consulting his accountant, Joe decides to spend $12,000 on new technology. His real cost, considering the tax savings, is just $7,800. Now that's a deal! And the check he's got to write to Uncle Sam next April will be a whole lot smaller.

Good to Know

Check with your accountant for details on how the Section 179 provision applies to your business. Usually, you must purchase and receive the equipment prior to December 31, so act quickly to determine which POS system is right for you! Granbury Solutiosn has several to choose from, including the new Thr!ve Tablet POS for iPad and Android. We’ve even got great packages to help you boost your business with online ordering, smart phone ordering and automatic loyalty marketing- all for one low monthly cost. Click here to learn more.

Update!

You can dow estimate your tax savings onine here.